Improving Profitability and OTIF by Using Product Segregation and Rationalization as a Tool for Strategic Decisions

Introduction

In this paper I will explore how Product Segregation and Rationalization goes beyond being an Inventory Management tool and becomes part of an overall strategy to increase profitability and improve Customer Service. I will also explain the impact Manufacturing Execution Systems (MES) and Enterprise Resource Planning (ERP) software can have if setup correctly.

The Downward Spiral of Low Supply Reliability

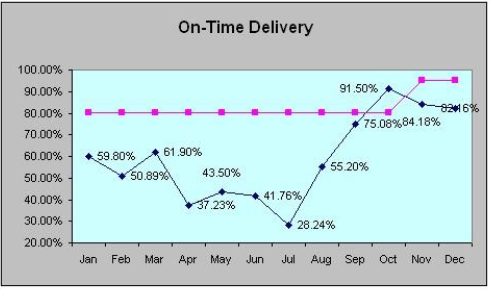

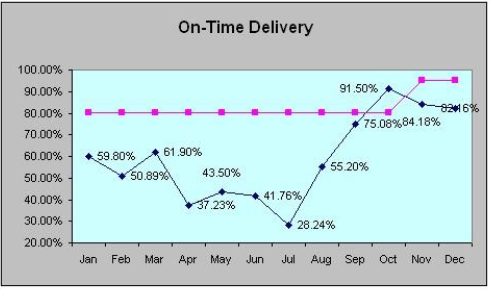

I recently participated in an analysis at a client with a serious problem of low OTIF (On Time and In Full) delivery, their on-time delivery was roughly 40%.

When service levels are so low, the whole supply chain system goes into a downward spiral. Every step of the supply chain, customers, both internal and external, tend to order and increase inventory to try and make up for the failures in delivery. That in turn puts more pressure on the capacity to deliver on time which of course causes OTIF to spiral even further down and so on and so forth.

When faced with such a situation, what I would call a “frontal attack” solution is not possible. Improving reliability and OTIF for the whole line is simply not going to happen.

It is in these instances when Product Segmentation and Rationalization is not only an Inventory Management tool anymore but rather it becomes part of a much larger improvement strategy.

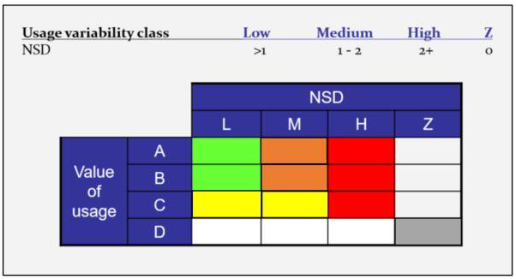

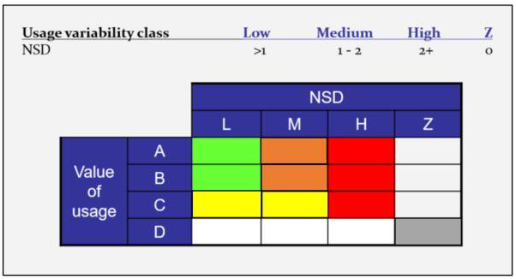

Using the 9 Box Tool to Segregate Products not only by the Level of Usage but also by the Variability of Usage

Looking at the items in the AL and BL quadrants of the 9 Box analysis graph below, those items used or sold a lot, very frequently and in consistent quantities, are the ones towards which the most effort to improve supply reliability should initially be geared. Especially when those are intermediate products, improving supply reliability for those products will improve the supply reliability of all the higher products made with them, having a geometrical progression effect on OTIF. As an example, I am extremely confident that concentrating on improving reliability on the AL and BL items, the client mentioned above would see an increase in OTIF to a level of 55 to 65% in the course of a couple of months.

Items in the AM and BM quadrants, those items used or sold a lot, but not very frequently and not in consistent quantities, those items should not be part of the production wheel and therefore the safety stock will need to cover not only their demand variation, that is deeper than the one of L items, but also the quantity needed to satisfy the average demand for the period between the lead time our customers, internal and external, give us and the lead time we need to make those products. The focus for those items should be to shorten the lead time we need to make them. That will allow us to reduce inventory without impacting OTIF delivery or better yet, improving it.

DZ items are those we have not sold or used during the analysis period. There is no strategic action that needs to be taken for those items. We should get rid of them. That is not a strategic decision, that is a

tactical one.

The Special Case of H Items

Items in the H quadrants, which are those items we used or sold sporadically or with big variations in quantities. My experience with hundreds of clients has been that the costlier aspect of H items is the disruption they cause to the regular manufacturing operations. It is very important to remember that because it is going to repeatedly come up in the analyses below.

There are three distinct situations that relate to items in the H quadrants and need to be analyzed separately:

- H items that ARE NOT REALLY H items, that there are one or more similar items in the L or M quadrants and that those items in the L or M quadrants have a tighter spec than the H item in question. An analysis of cost will most probably show that the cost of the disruption to the regular manufacturing operations is higher than the difference of the cost to produce a tighter spec item. In that case, the strategy should obviously be to produce ONLY the tighter spec items, whether we let customers buying the H items know we are providing them a higher quality product or not (*).

- H items that ARE NOT REALLY H items, that there are one or more similar items in the L or M quadrants except that the spec of the H item is tighter than that of the corresponding items in the L or M quadrants. There are two possibilities in this case, each with a different appropriate strategy:

- The cost of producing the corresponding items in the L or M quadrants to the tighter spec of the H item is lower than the cost of the disruption to the regular manufacturing operations. In this case the situation is similar to that in situation 1 above and the strategy should be the same, to produce ONLY the tighter spec items, whether we let customers buying the items in the L and M quadrants know we are providing them a higher quality product or not (*).

- The cost of producing the corresponding items in the L or M quadrants to the tighter spec of the H item is higher than the cost of the disruption to the regular manufacturing operations. In this case the H item is a TRUE H item and should therefore be treated like items in situation 3 below and the strategy should be the same as the one for those items.

- H items that ARE TRULY H items, where there are no similar items in the L or M quadrants or there are but the H item has a tighter spec and the cost of producing the corresponding items in the L or M quadrants to the tighter spec of the H item is higher than the cost of the disruption to the regular manufacturing operations. In this case, I will differ from the advice frequently offered by many consultants as follows:

- Increase the price of the H item, it is a “special” and Customers should pay more for specials. I know for a fact that our clients know their businesses better than we consultants do. I will therefore assume that if our clients could charge more for their product they would have already done it. They did not need the excuse that this is a “special” item to raise the price.

- Compel the Customers to buy the full batch. Again, I have to state that I know for a fact that our clients know their businesses better than we, consultants do. I will therefore assume that if our clients could compel their Customers to take a full batch of a “special” item they would have done that already, they did not need consultants to come along and point it out to the

Therefore, if Customers cannot be charged a higher price and they cannot be compelled to buy a full batch, what concession can be extracted from them, bearing in mind, as we stated above that in most cases the costlier aspect of H items is the disruption they cause to the regular manufacturing operations. The answer is Lead Time.Interestingly enough, accepting longer lead times is usually a lot less controversial. Customers are far readier to accept giving longer lead times than they are ready to pay higher prices or accept larger minimum quantities. Longer lead times will allow us to schedule those “special” items at a time that they least impact the regular manufacturing operations and therefore reduce the cost of the disruption. As a matter of fact, it might even be worth considering a price reduction in exchange for longer lead times.

Summary

The use of the 9 Box and Trade Off Tool analyses has proven to be a very effective inventory management tool. Its implementation has helped my clients substantially reduce their working capital tied up in inventory while maintaining or even improving Customer Service.

The purpose of this article has been to show that the 9 Box and Trade Off Tool analyses, in combination with a state of the art MES, like IMCO – CIMAG MES and the appropriate setup in an ERP system, can be a powerful tool to implement policies that will improve OTIF and Profitability.

More From Us

Schedule Attainment

Schedule Attainment – the Road to Satisfied Customers, Efficient Operations, and Higher Profits Introduction Scheduling is the last step in the Planning Process and it...

Read MoreHow to Successfully Implement a Computerized Planning and Scheduling System

How to Successfully Implement a Computerized Planning and Scheduling System Introduction The purpose of this article is to challenge readers to look at the implementation...

Read MoreReal Time Flow of Information Key to Improving Shop Floor Operations

Real Time Flow of Information Key to Improving Shop Floor Operations In order to remain competitive in today’s global manufacturing space, it is essential for...

Read MoreThe Importance of Traceability in a Manufacturing Environment

The Importance of Traceability in a Manufacturing Environment Introduction Manufacturing has become a lot more sophisticated in the last forty years. The expanded use of...

Read More